Options Trading has recently become popular in India in the last few years. There are several reasons behind its popularity. One is that content related to active finance and trading is trending on social media.

People of all ages are now actively participating in the markets, especially the derivatives market.

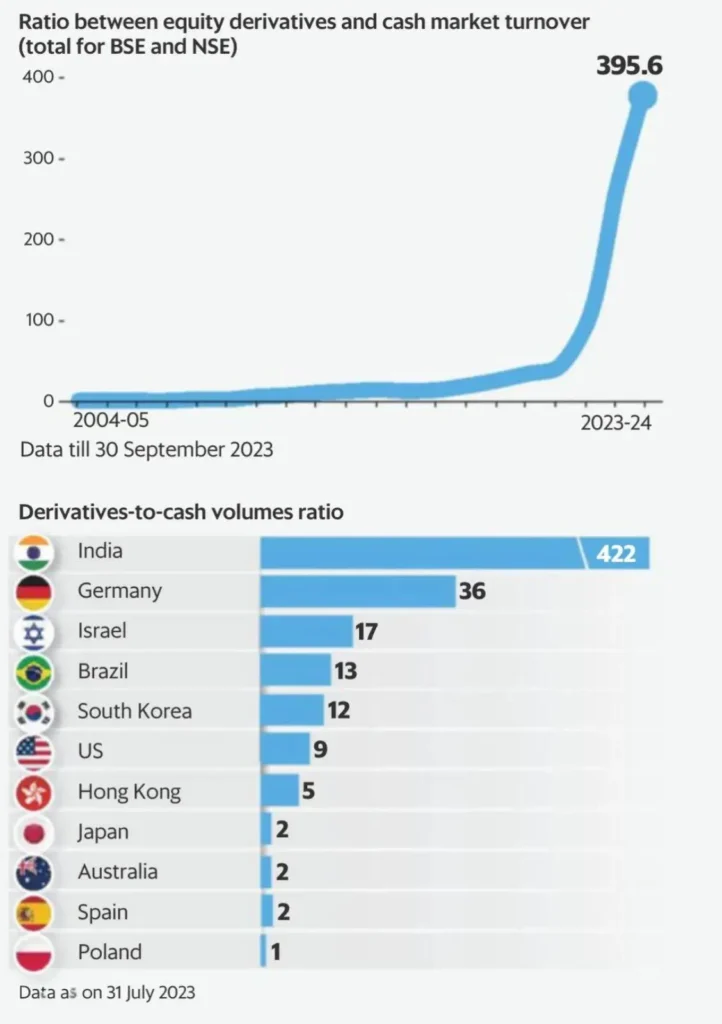

Here’s a chart showing the increase in participation in markets in different countries in recent years:

However, the truth is that 97 percent of people participating in derivative markets are making losses. According to a survey, the average loss amount is ₹50,000. Now, the question lies in whether one should start options trading in 2024. If yes, how to do so?

Also Read : – Understanding Put Options in Options Buying

Why To Start Options Trading In 2024?

The world of investing is continuously evolving. In 2024, the market offers people several opportunities to grow wealth and attain financial independence. Options trading is one of the most versatile and potentially lucrative investment vehicles. It’s a strategy available to traders of all experience levels.

If a trader wishes to dive into the world of options trading in 2024, here are some reasons why they should go for it:

Also Read :- What Are Call Options? Explained With Example

Diversification of Investment Portfolio

In investment, options trading gives an invaluable opportunity to diversify investors’ portfolios. When a trader includes options among other types of investments, such as stocks or bonds, traders can manage their risk and even increase their portfolio performance on a larger scale. Options cover numerous asset categories – stocks, indices, commodities, and currencies; consequently, this feature enables traders to benefit from various market opportunities.

Potential for Higher Returns

More options in trading are a type of investment that offers unique opportunities to achieve higher yields compared to traditional buy-and-hold strategies. Traders can amplify their capital to generate more profits from the same position and capitalize on sudden short-term price changes in the underlying assets by using options trading.

Flexibility and Versatility

One of the benefits of options trading is its flexibility and versatility. Options contracts are available in several forms, including calls, puts and more complex strategies such as spreads and straddles — each allowing traders to implement their investment and risk management objectives in many ways. Whether you’re looking to speculate on price movements, hedge existing positions, or earn passive income, options trading helps you implement a strategy tailored to specific goals and risk tolerance.

Limited Downside Risk

Unlike some forms of trading, options trading features built-in risk management mechanisms to limit downside exposure. When buying options contracts, our potential losses are limited to the premium paid for the option, and we’ll never lose more than that no matter what happens. That type of security and peace of mind allows traders and investors to use options trading to profit — even in a volatile market environment. More sophisticated risk management strategies include stop-loss orders and position sizing to protect trading capital from adverse market movements.

Open Free Demat Account : – Click Here

Access to Advanced Trading Tools and Resources

In today’s world of technology and innovation, options traders are fortunate to have a wide array of sophisticated tools and resources at their fingertips. Whether you’re just starting out or already experienced in trading, there’s a wealth of resources available to help you refine your skills and make informed decisions.

Imagine logging into your trading platform and being greeted by sleek, cutting-edge interfaces that provide real-time updates on market trends and data. These platforms offer valuable insights and analysis, giving you the information you need to stay ahead of the curve and make well-informed trading decisions.

But it doesn’t stop there. Options traders also have access to a treasure trove of educational materials and resources designed to help them navigate the complexities of the market. Brokerage firms and financial institutions offer webinars, tutorials, and comprehensive guides that cover everything from basic options strategies to advanced trading techniques.

How Much Money Is Required To Start Options Trading?

Here’s the answer to this age-old question. There is no specific amount to start options trading. However, the one-thumb rule is that whatever the starting amount is, it is a loss already. Only deploy the capital for learning purposes.

For instance, one can take ₹15,000-20,000 as a baseline to follow proper risk management but only trade with one lot. Moreover, before trading, one has to be aware of the markets. Before starting options trading, a trader should have information about the equity markets, commonly known as CASH markets.

In the first three months of options trading, invest more in equity markets and understand the movement of big market makers like Reliance and HDFC Bank. After understanding the equity markets, come to options trading and begin with it. It’s also a suggestion for beginners to start with NIFTY and then move upwards with the other indexes.

Don’ts Of Options Buying

Avoid Taking Out Loans for Investing

Sometimes, the temptation of rapid earnings in options trading can lead people to take out loans or borrow money to finance their trading endeavours. Nevertheless, using borrowed money to trade exposes traders to high financial risk and possible loss. In addition to increasing the impact of market volatility, trading with borrowed money comes with an additional cost: interest payments, which can get out of hand in erratic market conditions. Trading with funds that you can afford to lose without endangering your long-term goals or financial stability is crucial.

Avoid Making Too Many Trades

It’s simple to get sucked into the excitement of trading options when you first start. On the other hand, excessive trading can lead to issues down the road. Rash decisions, might raise transaction costs, put you in needless danger, and lower your profitability. Rather, concentrate on developing disciplined trading habits, adhere to a sound plan, and exercise patience and restraint. Recall that quality transactions yield more consistent profits over time than quantity.

Keep Losses From Getting Out of Hand

It’s normal to lose money when trading, but it’s crucial to manage those losses. To reduce possible losses on each trade, clearly define stop-loss levels and establish unambiguous risk management procedures. You may safeguard your future trading potential and prevent rash actions driven by fear or greed by stopping losses early and protecting your capital. Recall that in the world of options trading, mitigating your possible losses is as bit as crucial as optimizing your winnings.

Avoid Selecting Free Apps at the Expense of Quality

Zero-commission trading applications are marketed by many brokers as a means of reducing transaction fees. Even while these apps might look like a fantastic deal, it’s crucial to remember that you shouldn’t let go customer service, dependability, and basic features to save money. Even if there is a minor price involved, selecting a trustworthy brokerage platform with robust trading infrastructure, dependable execution, and attentive customer support may ease your worries and offer a flawless trading experience.

You May Like

FAQ

How much money should I have to start options trading?

For instance, one can take ₹15,000-20,000 as a baseline to follow proper risk management but only trade with one lot. Moreover, before trading, one has to be aware of the markets. Before starting options trading, a trader should have information about the equity markets, commonly known as CASH markets.

Why To Start Options Trading In 2024?

The world of investing is continuously evolving. In 2024, the market offers people several opportunities to grow wealth and attain financial independence. Options trading is one of the most versatile and potentially lucrative investment vehicles. It’s a strategy available to traders of all experience levels.

Don’ts Of Options Buying ?

Avoid Taking Out Loans for Investing

Avoid Selecting Free Apps at the Expense of Quality

Keep Losses From Getting Out of Hand

Avoid Making Too Many Trades

7 thoughts on “Proper Capital To Start Options Trading In 2024”